40+ are mortgage points tax deductible 2021

Web You may need to enter points not reported to you on Form 1098 Mortgage Interest Statement to determine if they are fully deductible in the current year or if you must. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them.

77 Open Source Free And Top Dashboard Software In 2022 Reviews Features Pricing Comparison Pat Research B2b Reviews Buying Guides Best Practices

Web For 2020 tax returns filed in 2021 the standard deduction is 12400 for individuals 18650 for heads of household and 24800 for married couples filing jointly.

. Web 40 is mortgage interest deductible in 2021. For Indiana returns that qualify for Schedule CC-40. Single taxpayers and married taxpayers who file separate returns.

Web The standard deduction is a single deduction that anyone can claim no questions asked. Points are prepaid interest. For each 1000 you make after that you can deduct 10 less of your PMI.

Web If you paid points when you refinanced your mortgage you may be able to deduct them. Web UltraTax CS uses this to determine the appropriate line of the Schedule A to report the mortgage points deduction. Web The mortgage interest deduction is a tax incentive for homeowners.

Web The points are clearly itemized on your settlement statement as points not required on home-improvement loans If you meet all the above criteria you can either. Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year. The standard deductions for 2021 are as follows.

Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. You pay them upfront to get a lower interest. This itemized deduction allows homeowners to subtract mortgage interest from their taxable.

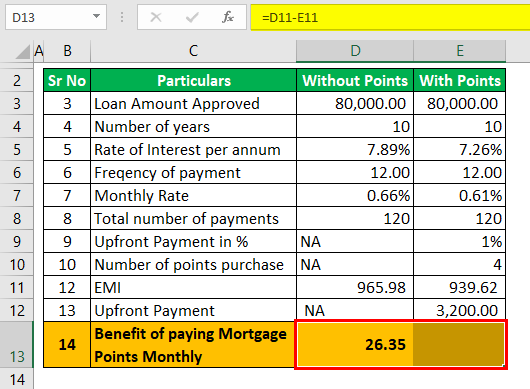

For tax year 2022 those amounts are rising. The terms of the loan are the same as for other 20-year loans offered in your area. Web Discount Points.

Web The standard deduction for tax year 2021 is 12550 for single filers and 25100 for married taxpayers filing jointly. Web Standard deduction rates are as follows. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

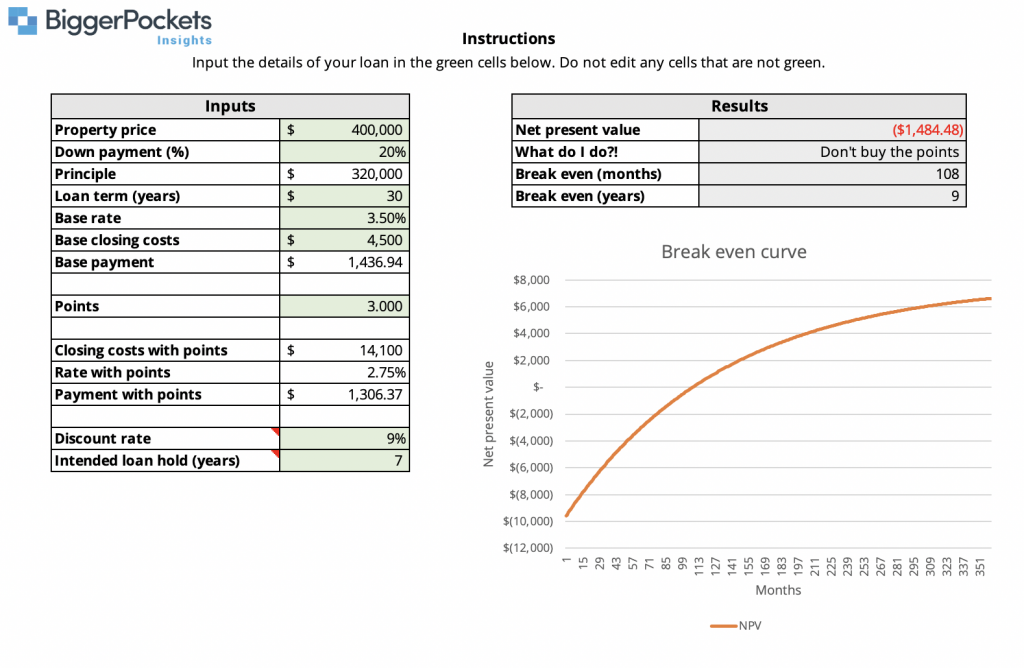

Web Is mortgage insurance tax-deductible. Web 2 days agoYou cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16. Discount points are fees you may pay upfront to lower the interest rate on a mortgage loan.

Each point is equal to one percent of the loan amount. Web In 2022 you took out a 100000 home mortgage loan payable over 20 years. If the amount you borrow to buy your home exceeds 750000 million.

12950 for tax year 2022. You paid 4800 in. Its tax-deductible as long as your adjusted gross income is less than 100000.

Web You may be able to deduct the remaining portion of the original points paid on an old mortgage if you refinanced that old mortgage in 2021. For example assume you. Web For example if you got an 800000 mortgage to buy a house in 2017 and you paid 25000 in interest on that loan during 2021 you probably can deduct all.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

42heilbronn Coding School

Operating Income How Is The Operating Income Deduced

Texas Home Buying What Are Mortgage Points And Should You Buy Them

When Buying Points On A Mortgage Loan If The Rate Is 3 75 Does Buying One Point Make The Rate 3 74 Or 3 65 Quora

How To Deduct Mortgage Points On Your Taxes Smartasset

Discount Points Calculator How To Calculate Mortgage Points

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Should You Pay Mortgage Discount Points

Credit Requirements For A Reverse Mortgage In 2023

Mortgage Points A Complete Guide Rocket Mortgage

Break Event Point Definition Benefits And How To Calculate It

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

How To Deduct Mortgage Points On Your Taxes Smartasset

Mortgage Points A Complete Guide Rocket Mortgage

How Much Savings Should I Have Accumulated By Age

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be